Welcome 👋🏼 The “Top Blog”—also known as “Top Breakouts from Last Week”—highlights standout performers from last week’s MDA Breakout Stock Picks. It's like a highlight reel of the best picks from previous weeks.

We publish new MDA Breakout picks on the V&M Dashboard every day at 10:30am ET and again at 4:15pm ET. Subscribe for a 14-day Free Trial to get today’s picks, or sign up on this blog for free email updates to follow along and see how our best picks perform.

Each day, about a week after an MDA Breakout Stock appears on the V&M Dashboard, we post a new entry on this blog to showcase the pick(s) that outperformed during the holding week. The ROI numbers on this blog reflect a 5-day hold, though many picks continue performing well beyond that timeframe.

The Top Blog follows a cadence: 42 new Breakout Stocks are published on the V&M Dashboard, each day. These picks are tracked for 5 trading sessions—generally one week, except during market holidays. After the market closes on the fifth trading day, the Top Blog posts a new entry featuring the best-performing MDA Breakout pick(s) from the previous week.

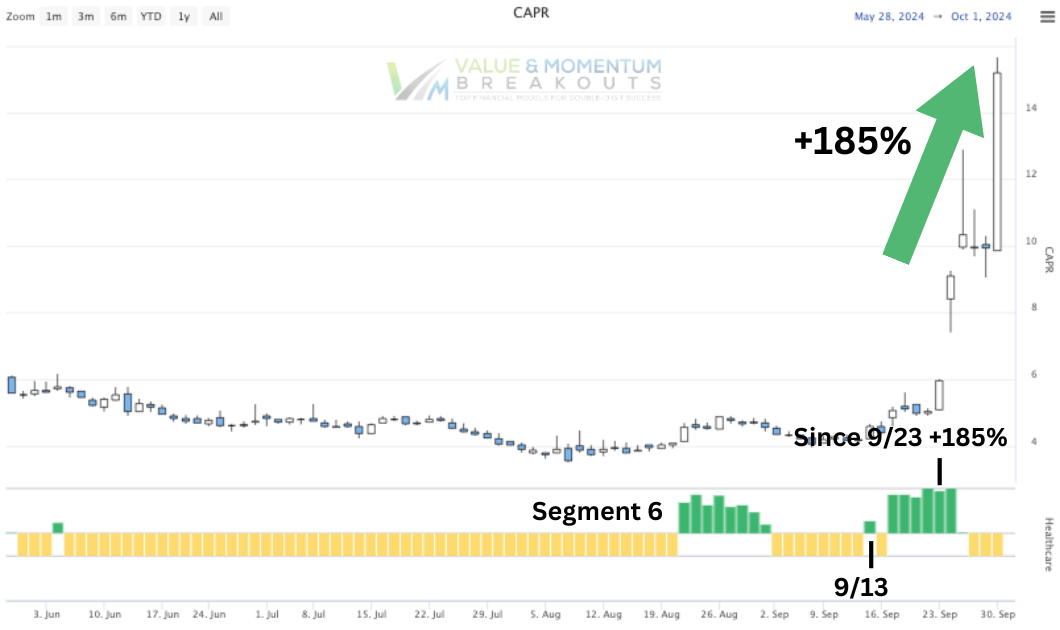

Take this actual example 👇🏼 from September 23rd...

The picks posted on this blog are no longer active MDA Breakout picks. This blog only highlights picks from previous weeks.

New picks are published twice-daily on the V&M Breakouts Dashboard. Picks published on the Dashboard remain active until the next batch of picks are published. Picks are published at 10:30am and 4:15pm on the V&M Dashboard which requires a separate subscription.

For measuring ROI, picks are held for a week and the ROI is calculated using the closing stock price after the 5th day of trading. See the "How it works" section above for an example.

Short answer: no. The picks posted on this blog are at least a week old and may no longer be active picks. The MDA Breakout picks are derived from Segment 6 (the Positive Acceleration Segment) and this blog does not track which stocks are still in Segment 6. Many stocks persist in Segment 6 long after they are posted as picks on the V&M Dashboard but this blog does not track when stocks enter or exit Segment 6. A subscription is needed to track individual stocks and which MDA Segments they are in.

Use the white button, in the blue bar below, to Subscribe for a 14-day Free Trial to get today's MDA Breakout Picks and start trading them right away.

After the Free Trial is over, it is a paid subscription— which is different than signing up to receive email updates from the Top Blog. This blog only publishes highlights from previous weeks. Like a highlight reel of the best picks published on the V&M Dashboard in previous weeks.

For simplicity and consistency, the ROI for all picks highlighted on the Top Blog use a simple 5-day hold to measure how they performed over a one-week period. Of course many stocks (e.g. NVDA, TSLA) have remained in Segment 6 for many months and the ROI on those picks was much larger than the the 1-week ROI.

We do not necessarily recommend the 5-day hold. Typically it's best to monitor each stock on a case-by-case basis to evaluate it's movement in and out of the Positive Acceleration Segment (Segment 6) and Negative Acceleration Segment (Segment 2).

The MDA Breakouts Algorithm provides a highly reliable method for classifying individual stocks into the 7 Segments of the Momentum Cycle.

There is no perfect way to model the extreme complexities of the stock market; of human behavior; of panic and exuberance; of earnings surprises and corporate calamities. However, in all my years of trading this model has delivered for me the most profitable balance between signal and noise.

Learn more in the Getting Started Guide.

The MDA Breakouts Algorithm classifies seven different conditions of "price change" activity into seven segments for analysis.

Rather than using "price activity" to predict "change in price", the goal is to determine the strongest market variables which best distinguishes between the seven price behaviors illustrated in the seven columns below across the momentum cycle.

Learn more in the Getting Started Guide.

There are different strategies on how best to use these picks to compound your returns. One strategy is to set your sell targets at 5% or 10% gains and repeat the process as frequently as possible for every breakout pick that hits the target. Another option is to monitor the stock and sell when it exits Segment 6 or if you want to hold it longer you could wait until it enters Segment 2.

Learn more in the Getting Started Guide.

Subscribe for a 14-day Free Trial to get today's MDA Breakout Picks and start trading them right away. 21 new Breakout Stocks are published twice-daily at 10:30am and 4:15pm ET.

Start your 14-day Free TrialThe Top Blog posts highlights from last week's MDA Breakout Stock Picks, published twice-daily on the V&M Breakouts Dashboard. Subscribe for a 14-day Free Trial to get today's picks or sign up to get free email updates.